Internet of Things (IoT) devices are everywhere, collecting, transmitting and processing vast amounts of data, with trends predicting some 42 billion devices being online and connected by this time next year (1). Alastair McLeod, CEO of remote connectivity provider, Ground Control, examines the role of satellite networks in connecting the most remote areas of the planet, and what obstacles they might face as network operators demand ever-greater use of the finite radio spectrum

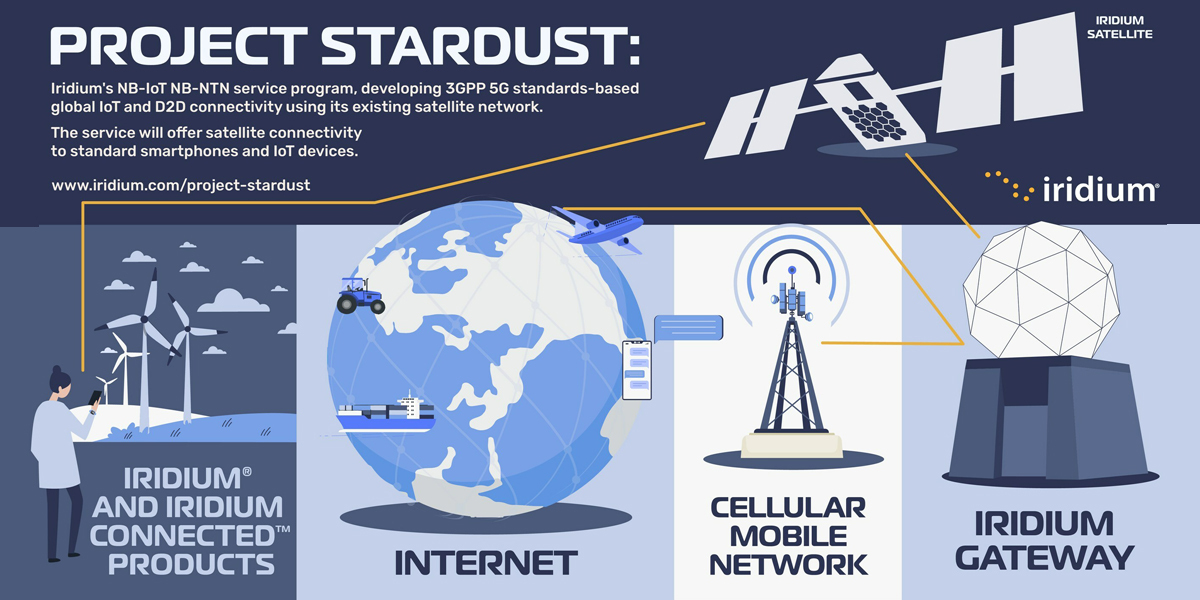

Add to this new standards-based technologies that enable devices to communicate directly with satellites without a proprietary modem, and the battle for delivering seamlessly integrated cellular and satellite connectivity is on.

Transforming industries

IoT devices are transforming industries by enabling real-time data collection, monitoring and automation. Whether it’s asset tracking, monitoring soil conditions in agriculture, or managing critical infrastructure in remote areas, IoT devices rely on constant, reliable connectivity.

In urban settings, connectivity is less of an issue thanks to established mobile networks, although urban canyons are challenging this assertion in the most densely populated cities. But in rural or remote areas, where many industrial-level IoT devices are used, network coverage can range from patchy at best to non-existent.

In the effort to deliver reliable, global connectivity, this is where non-terrestrial connectivity steps in, with the major telcos turning to satellite technology to bridge coverage gaps in remote and underserved areas. Direct-to-Device (D2D) is full of promise in solving these challenges, but what is it, and what could it mean for IoT?

D2D enables unmodified cell phones and IoT devices to communicate with satellite constellations. In essence, the same communications module that allows your sensor / gateway / array to connect to terrestrial networks will also allow you to connect to non-terrestrial networks (NTN). Coverage remains dependent on the satellite network(s) your device is compatible with, but it invariably expands the reach of IoT connectivity at a lower cost, and less inconvenience, to users.

There are two ways to deliver D2D. The first is to launch new satellites specifically designed to talk to existing IoT devices, and the second is to add a new, mass-produced chipset to IoT devices so that they can talk to existing satellite networks. This could either be a proprietary chip, which allows the device to speak to a single satellite network, or a standards-based chip, which would allow the device to roam on to any network built to the same standards.

There are pros and cons to each approach; in the case of purpose-built satellites, the main plus is that there is a large market of existing devices. However, as we will see, there are performance, spectrum, and funding challenges to overcome. In the case of new chipsets, whether standards-based or proprietary, it will take time for these to be developed and deployed at scale.

The battle for bandwidth

One of the obstacles in the greater ubiquity of direct-to-devices is tied to radio spectrum availability and licensing. All network operators rely on the electromagnetic spectrum to carry data. However, the parts of the spectrum best suited to IoT transmissions are, for the most part, already licensed, either to long-established Satellite Network Operators (SNOs), or terrestrial Mobile Network Operators (MNOs). This limits the ability of new satellite operators to provide coverage independently.

This is why new SNOs like Lynk, Starlink and AST SpaceMobile are partnering with MNOs to access their spectrum. These partnerships will prove crucial for delivering wider coverage; without them, the SNO cannot ‘land’ its data. And if that’s not challenging enough, in more densely populated countries, MNOs suffer from connectivity black spots, intermittency or very high latency, leaving no spare spectrum to licence out to an SNO. This battle for spectrum presents a serious challenge to the newer satellite constellations.

Working with established SNOs such as Iridium and Viasat, who have licensed spectrum and landing rights, is the fastest way to achieving global service and a high capability network, and is the route service provider Skylo has taken to deliver service.

Driving D2D innovation

The recent developments in direct-to-device satellite connectivity, such as Iridium's NTN Direct service and Verizon’s partnerships with AST SpaceMobile and Skylo , highlight a broader industry trend: the integration of satellite and terrestrial networks to provide seamless, global connectivity. While Verizon initially focused on delivering D2D services via AST SpaceMobile using Verizon’s spare spectrum, the Skylo deal introduces a complementary solution.

By utilising Skylo’s technology and agreements with existing satellite constellations (currently, Ligado and Viasat), Verizon can offer low-bandwidth services like emergency messaging and location sharing, without needing to free up more terrestrial spectrum. Moreover, Skylo’s services leverage the NB-IoT standard, whereas AST SpaceMobile’s service will leverage LTE; by having agreements with both companies, Verizon can offer its customers uninterrupted connectivity in remote areas, on many more compatible devices than if they chose one standard or the other.

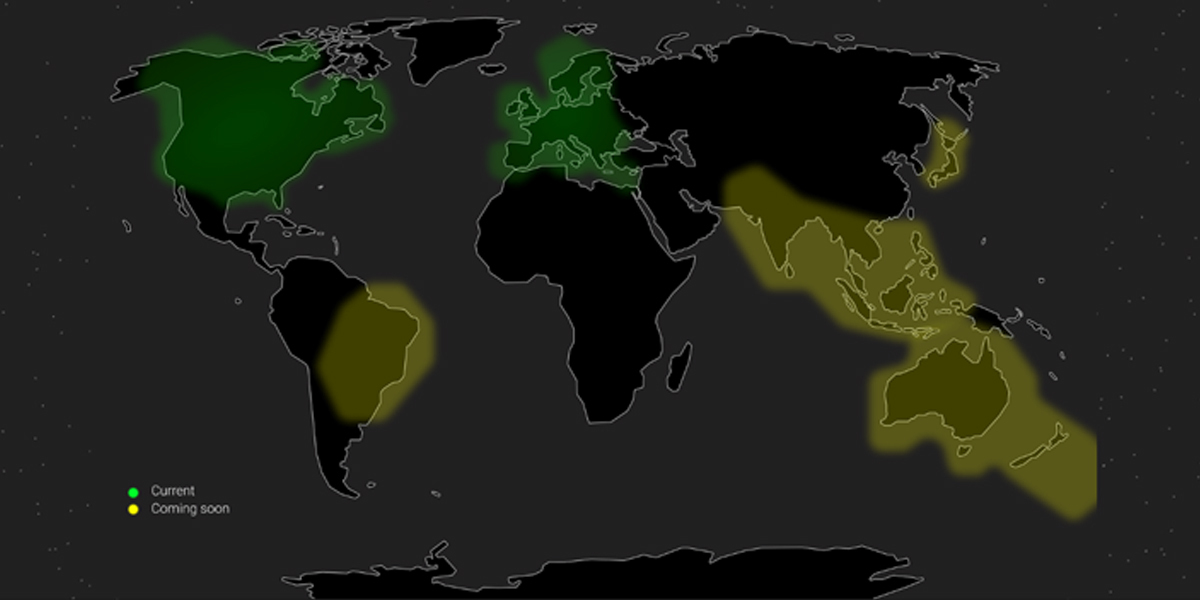

Iridium’s upcoming NTN Direct service, set for global rollout by late 2025,(2) furthers this trend by enabling NB-IoT satellite connectivity through industry-standard chipsets. This development will allow IoT devices to communicate directly with satellites in Iridium’s low Earth orbit (LEO) constellation. While its acceptance into 3GPP for NB-IoT over non-terrestrial networks (NTN) is a major step toward enabling global satellite IoT connectivity, the technology is still in development.

A golden bullet for IoT?

These developments in D2D satellite connectivity certainly mark significant progress in global communication. But while they are exciting, they come with limitations that highlight the continued relevance, and necessity, of proprietary solutions.

Satellites are powered by photovoltaic solar panels, but the relatively modest size of these solar panels limits how much power they can derive from the sun. As it stands, there isn’t a path that sees satellites behave identically to terrestrial telephone masts; their power limitations mean they cannot handle as much throughput.

NB-IoT and LTE are both cellular standards, and while the satellite industry is trying to accommodate them, they, coupled with the power constraints, place limitations on the amount of data that can be passed via a satellite connection. Anyone expecting parity with cellular should reset their expectations, at least for the foreseeable future.

On the other hand, proprietary communication services like Iridium’s Certus 100 and Viasat’s IoT Nano, were specifically created for efficient communication with satellites. They move data in a way that is optimal for the satellites, and as such, they can transmit more data in more flexible formats than standards-based services.

D2D, as we’ve discussed, revolves around the promise of unmodified IoT devices; as a user, I expect to purchase a device that can work on both satellite and cellular networks without me having to change anything. Because cellular connectivity is by many orders of magnitude a larger market than satellite connectivity, naturally, the end goal is for satellite networks to adopt the cellular standards. But we anticipate proprietary satellite solutions co-existing for a very long time, perhaps in perpetuity, because of the greater flexibility and throughput they can deliver, albeit at a greater expense to the user.

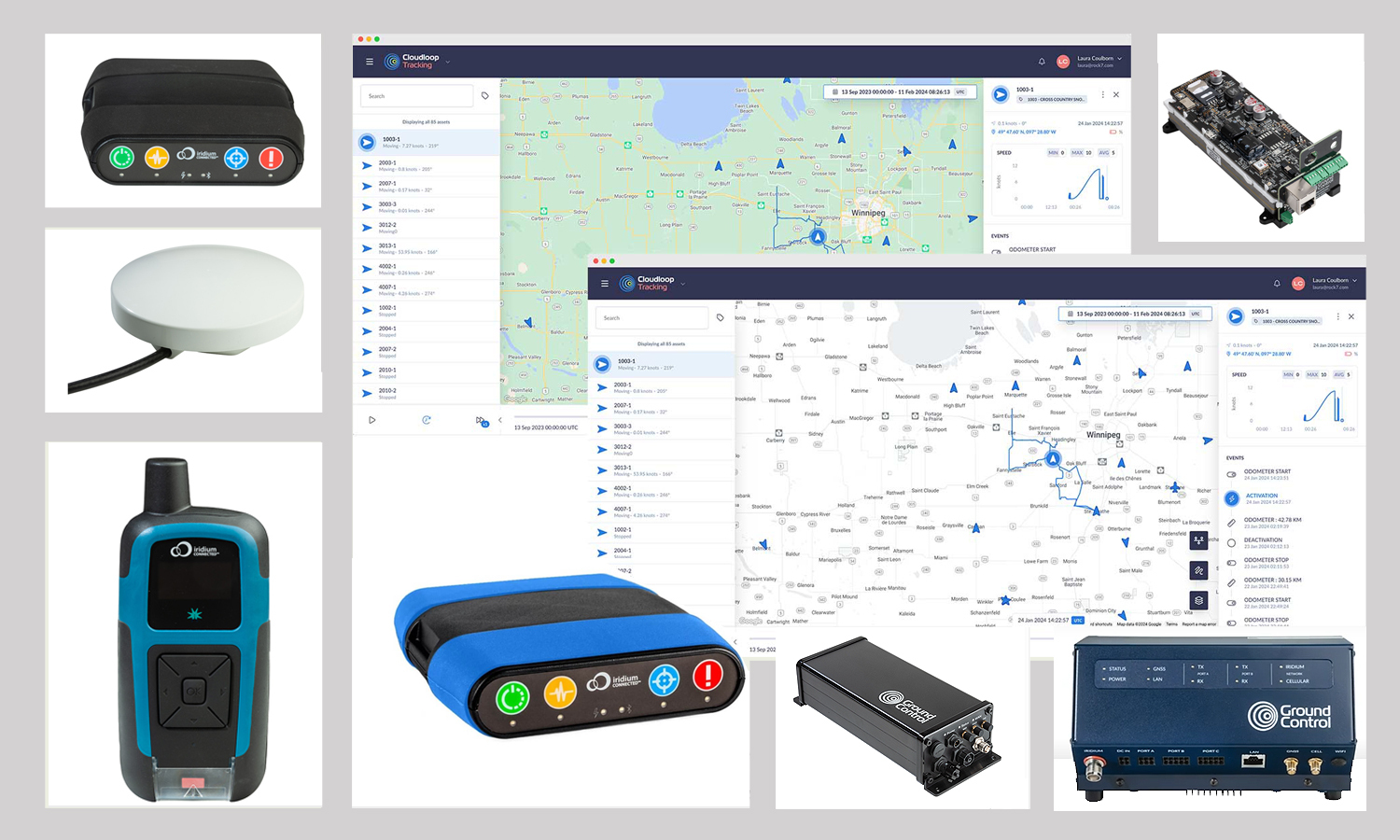

At Ground Control, we’re testing standards-based solutions alongside proprietary options, so that we can make tailored recommendations based on each use case. Whether it’s protecting wildlife from poachers in Zambia or supporting critical telemetry systems for major utility infrastructure like dams and pipelines, our approach delivers reliable, scalable connectivity across a wide range of applications - offering both affordability and virtually limitless potential.

What does the future hold?

As IoT explodes even further, the requirement to deliver global, easy to deploy, cost-effective connectivity grows in urgency. And while standards-based D2D technology holds great promise, the reality is that the technology is still evolving, and issues such as spectrum limitations and the scarcity of compatible devices remain unresolved. There’s a further challenge of finding sufficient endpoints to justify the launch costs.

Current satellite IoT applications, which often demand guaranteed data delivery and low latency, are unlikely to fully transition to D2D technology due to data throughput, speed and reliability requirements that will not be satisfied outside of a proprietary solution.

Therefore, standards-based D2D is, in our view, less likely to cannibalise the existing satellite IoT market, and more likely to unlock new, less mission-critical, but still highly valuable, use cases. The economics of these use cases are likely to require that the satellite connectivity is much lower cost, and so more subscribers will be needed for the service provider to remain viable.

For new companies venturing into the D2D space by launching satellites compatible with terrestrial waveform technologies, there are significant capital expenditure hurdles. To provide a commercially viable service, they must launch a number of satellites, at a steep cost, while banking on potentially tens of thousands of subscribers to recoup their investment.

Ultimately, it’s a high stakes gamble, as most of the substantial costs must be incurred upfront before service can even be offered. Sadly, there’s a real risk that some of the less well funded market entrants could run out of momentum before even reaching commercial viability.

While the future of D2D and always-on connectivity remains bright, its path to success has hurdles to overcome. The financial risks are high, with substantial upfront costs and uncertain subscriber adoption. And for the organisations that need reliable connections right now, the connective technologies of today remain absolutely business critical.

(1). https://www.satellitetoday.com...

Alastair Macleod is CEO of remote connectivity provider, Ground Control, with offices in the UK and USA and with 4,500 customers in 130 countries. The business uses satellite and cellular technology to connect people and things, and designs and builds its own technology, from low power, small form factor satellite IoT devices through to handheld, two-way messaging-enabled trackers

Subscribe to our newsletter

Stay updated on the latest technology, innovation product arrivals and exciting offers to your inbox.

Newsletter