In today’s rapidly evolving financial services sector, understanding the valuable connection between location data and Earth Observation (EO) technologies is critical. The UK Space Agency’s Unlocking Space for Business programme, in collaboration with Ordnance Survey (OS), has shed light on how accurate and detailed location data can enable better investment decisions, particularly in sustainability and biodiversity net gain

As part of this process, two consecutive workshops were held where insights were gathered from leaders within the Financial Services sector and from technology enablers and solutions providers, all of which helped identify the needs and challenges of the sector in terms of use and delivery.

The findings from this work have been encapsulated in a 43-page final report that describes what was done and why; recommends the next steps; articulates the high-level business case, and summarises recommendations for both Department for Science, Innovation & Technology (DSIT), Partners and UKSA.

Navigating an increasingly complex landscape

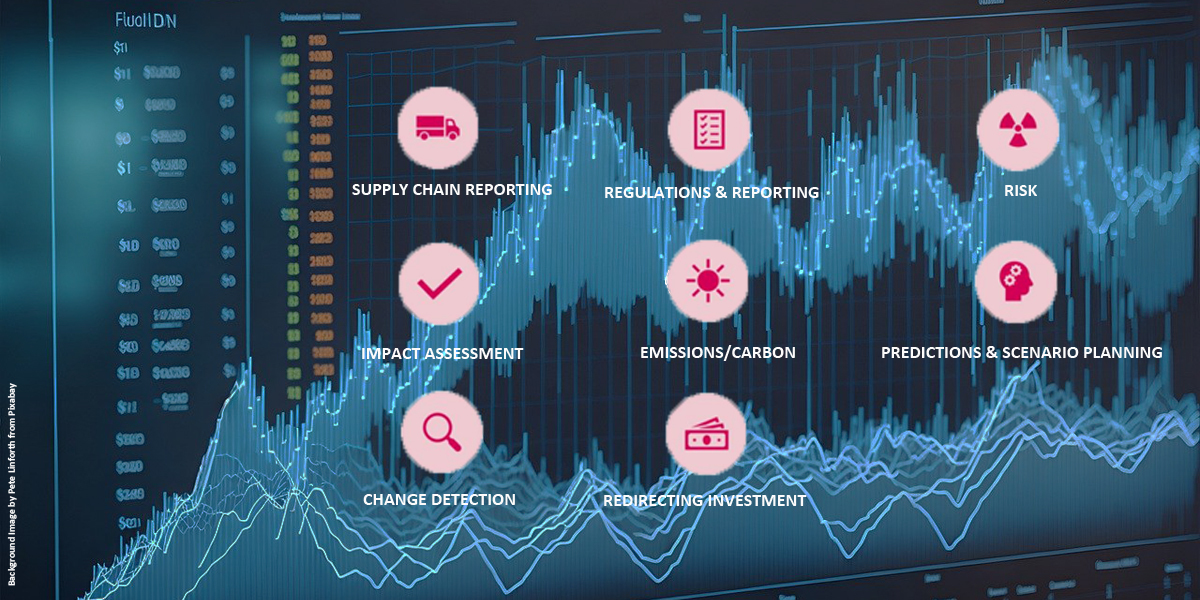

The financial sector often faces challenges when it comes to asset location and risk assessment, which limits the effectiveness of using EO data. Financial institutions are navigating an increasingly complex landscape of Environmental, Social, and Governance (ESG) requirements, with sustainability a moral responsibility. However, the lack of knowledge surrounding asset location has left markets disconnected from the physical world in which they aim to invest. This is largely because they don’t know where to target their observations and are, therefore, unable to use EO data effectively for risk evaluation and decision-making.

Ordnance Survey can address this disconnect by integrating its trusted geospatial data with EO insights, creating a unified system that connects financial services with physical assets and environments. This will better enable the location of valuable assets and understand their physical location in relation to the environment and surrounding areas, monitor environmental impact, and ensure compliance with ESG standards.

Key challenges and opportunities

Despite the potential opportunities, there are significant barriers to overcome, including a lack of trust in location-based assessments and limited awareness of the value that space-derived insights can provide. The Financial Services sector is currently spending millions on trying to navigate the data landscape with limited success. Authoritative data platforms, like the EO DataHub, which is a single portal for accessing and processing satellite data, could be the catalyst for the widespread adoption of EO technologies across the financial sector, providing clarity of where assets are located for risk management and sustainability efforts.

OS has been working alongside the UK space sector to improve the accessibility and usability of EO data. Through collaboration with initiatives like Space4Climate, and leveraging new EO technologies such as GHGSat and SatVu, OS has identified a critical need for improved understanding and interpretation of EO data within the financial industry.

By combining EO and location data, financial institutions can enhance due diligence, portfolio monitoring, and predictive analytics. This could revolutionise how risk is managed across various sectors, including real estate, agriculture, utilities, and manufacturing.

The OS National Geographic Database (OS NGD) is the latest product offer from OS and contains a wealth of data including over 25 million land use parcels. This will help pinpoint and identify optimal locations for investment but also support site location analysis such as size or current usage, but also the land cover and topographical features within these areas to identify potential flood risks for example.

Mark Tabor, Principal Consultant at Ordnance Survey commented: “There are large gaps in terms of understanding what you can and cannot do with EO data. With a trusted organisation like Ordnance Survey providing the data and expertise, you can unlock real value and build greater trust when tracking investments, identifying vulnerabilities and making critical decisions. As an example, from where to fund and manage the transition of those assets into a more climate-resilient state, to understanding the risk of climate-related effects and investing in the right place.”

“At NatWest we’ve been exploring how Earth Observation data could help the bank meet its climate and wider environmental ambitions, regulatory obligations, and more importantly, how we can support our customers on their transition journeys as part of a more sustainable economy. Previous work has demonstrated some of what’s possible in this space, with our Energy Help and Support Hub ‘Explore solar’ report generator that gives commercial customers an indication of solar potential within minutes.

“Whilst we’re excited about the possible opportunities for financial institutions in this space, there are challenges that need to be overcome in order for Earth Observation data to deliver tangible results. Better location data has a huge role to play in maximising meaningful application of any geospatial data and unlocking the unique value within Earth Observation data.” Tracie Callaghan, Innovation Lead Climate Data, NatWest.

Real-world applications

Financial services companies have a major opportunity to utilise EO data for compliance monitoring, regulatory reporting, and project finance. Geospatial insights can help pinpoint environmental risks, monitor changes over time, and make portfolios more resilient to transition risks. This will not only provide a competitive advantage in ESG investing but also protect businesses from the growing threat of climate change and nature-related risks now and in the future.

Economic losses from natural and climate related disasters are estimated to cost more than USD 330 billion per year (United Nations, 2024). Additional analysis from the Green Finance Institute suggests that between 8% and 53% of the portfolios of the seven largest banks are also exposed to transition risks.

EO data could assist regulators such as the Financial Conduct Authority (FCA) to test claims, and the Bank of England for stress testing, ensuring that banks and insurers are resilient against another potential financial crisis due to climate change and asset stranding.

Hannah Cool, COO of Bankers for Net Zero commented; "Harnessing precise location data alongside Earth Observation technologies is pivotal to transforming the financial services sector, financing more sustainable behaviours, and enhancing risk management.

“The real challenge lies in overcoming the sheer volume of low-quality data and outdated models that erode trust across the industry. To unlock true value, we need clear data standards and open data sharing frameworks that mid-market players can adopt. As well as collective data sharing agreements to tap into standardised asset-based information.”

Nikhil Chouguley, Partner, Head of Sustainability Solutions, Reframe Capital, added; “Geospatial data combined with Artificial Intelligence is emerging as an integral part of climate and nature risk analysis. The EO will be a game changer for modelling sustainability risks associated with infrastructure, real estate and agroforestry assets.”

Building a sustainable future

The financial sector is beginning to witness a shift towards a new generation of investors who are looking at more sustainable models. This is creating an increased demand for sustainability-linked investments, which require objective-based evidence of environmental and social impact. EO data, combined with geospatial insights, can provide this much-needed validation, giving investors the confidence in portfolio performance and ESG compliance.

The integration of satellite EO data with location intelligence will empower financial institutions to align their operations with net-zero targets, optimise resource allocation, and manage investments in a more climate-conscious manner. Whether monitoring greenhouse gas emissions, or predicting and preventing environmental degradation, including deforestation, the possibilities for transformative change are vast.

Sustainable investment in energy supply chains and metal mining can also be promoted by using EO data to monitor environmental impact and assuring compliance with sustainability standards. Real estate asset management can be transformed by integrating microclimate insights and other geospatial data into property valuation and market trend analysis. EO data can also provide a comprehensive view of global trade and supply chain dynamics when combined with Automatic Identification System (AIS) location technology to monitor shipping routes, emissions, commodities, and fleets. This will optimise operations, help direct ESG investments and support policy development.

Conclusion

The future of the financial services sector will greatly benefit from harnessing the power of geospatial and EO data. By addressing the current knowledge gaps, promoting data standardisation, and building trust in EO-derived insights, the financial industry can make more informed, sustainable decisions. This will not only help mitigate environmental risks but also create new opportunities for nature-positive investments.

As the financial landscape continues to evolve, the integration of precise location data with EO technologies offers a clear path forward—driving sustainability, enhancing risk management, and ultimately creating a more resilient, future-proof financial system.

To read the full report, please download from https://www.ordnancesurvey.co....

Subscribe to our newsletter

Stay updated on the latest technology, innovation product arrivals and exciting offers to your inbox.

Newsletter